when will estate tax exemption sunset

Proper planning may be necessary to make sure you are taking full advantage of the current exemption and arent negatively affected when it decreases. Maybe not tomorrow but the sunset of our historically high estate tax exemptions is comingand with the election on its way it could be sooner than you think.

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation is expected to be.

. This increase in the estate tax exemption is set to sunset at the end of 2025 meaning the exemption will likely drop back to what it was prior to 2018. On January 1 2018 the Tax Cuts and Jobs Act TCJA added provisions to the tax code to reduce income tax burdens. Significant provisions scheduled to expire.

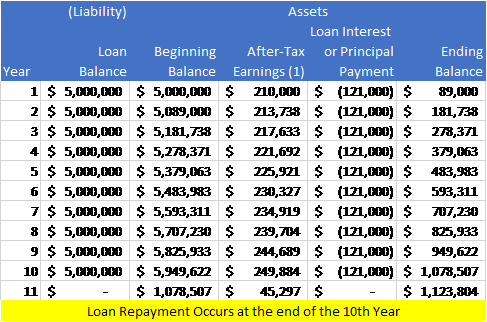

The current exemption is based on legislation that substantially raised the yearly lifetime exemption amount starting in 2018. For individual taxpayers almost all these provisions expire or sunset at the end of 2025 while most business provisions are permanent. The grantor of the trust has the flexibility to forgive the loan prior to the sunset date and complete the gift.

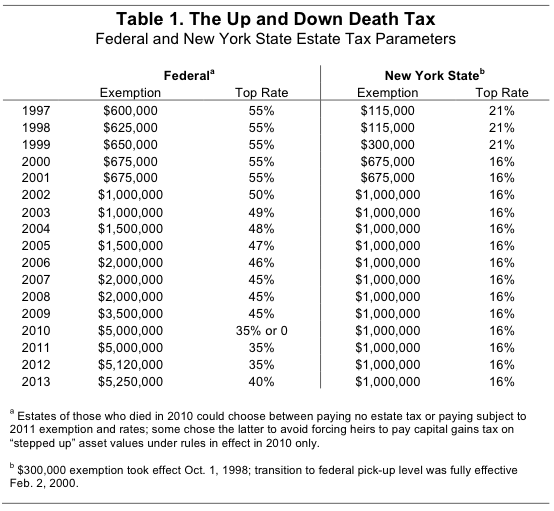

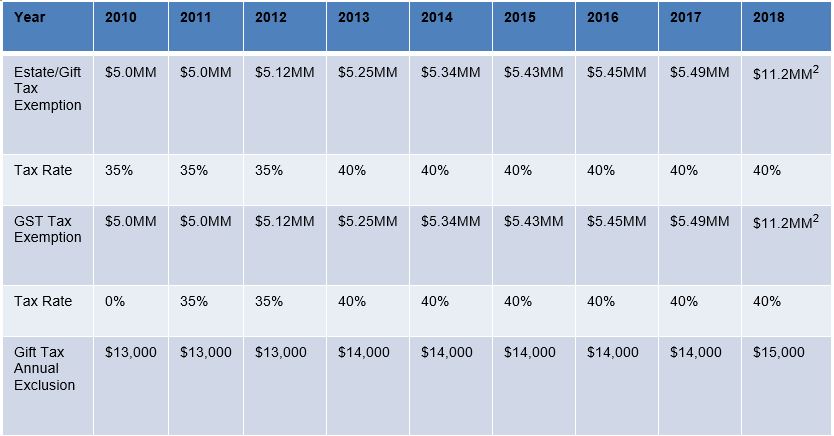

Maybe not tomorrow but the sunset of our historically high estate tax exemptions is comingand with the election on its way it could be sooner than you think In 2018 the Tax Cuts and Jobs Act TCJA doubled the lifetime gift estate and generation-skipping tax exemption to 1118 million from 56 million. Couples can pass on twice that amount or 228 million. As the IRS released on November 22 2019 The Treasury Department and the Internal Revenue Service today issued final regulations confirming that individuals taking advantage of the increased gift and estate tax exclusion amounts in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to drop to pre.

Nothing has happened politically and the doubling of the estate and gift tax exemption is scheduled to sunset on January 1 2026 at the end of the 7 th year. This means starting in 2019 people are permitted to pass on tax-free 114 million from their estate and gifts they give before their death. After that the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation is expected to be about 62 million.

On November 26 2019 the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to drop to pre-2018 levels. Many however werent permanent. Transfers from one spouse to the other to create or separate community property are exempt.

Although the vast majority of Americans have estates that fall under the estate and gift tax exemption the exemption is set to be cut in half in 2026. The window for planning may be. Thats why December 31 2025 will be an important day with 23 provisions scheduled to sunset.

In this case on Jan. Things to know before estate tax laws sunset in 2025. However the favorable estate tax changes in the TCJA are currently scheduled to sunset after 2025 unless Congress takes further action.

You may recall that the 2017 Republican tax reform legislation roughly doubled the estate and gift tax exemption. Federal Estate Tax Exemption Sunset Is Not Far Off Jun 8 2021 Blog Maybe not tomorrow but the sunset of our historically high estate tax exemptions is comingand with the election on its way it could be sooner than you think. However that law includes a sunset.

Community property dissolution of marriage or domestic partnership legal separation decree of invalidity - WAC 458-61A-203 Community property. With adjustments for inflation that exemption in 2020 is 1158 million the highest its ever been reports the article Federal Estate Tax Exemption Is Set to ExpireAre You Prepared from Kiplinger. The Build Back Better bill thats been bouncing around in Congress included a provision that would accelerate the sunset provision so that the.

1 2026 the estate tax exemption is set to drop back to what it was before 2018. The current estate and gift tax exemption is scheduled to end on the last day of 2025. The portability of a deceased spouses unused estate tax exemption but not generation-skipping transfer tax exemption to the surviving spouse remains in effect.

2 In addition the 40 maximum gift and estate tax rate is set to increase to 45 in 2026. In 2018 the Tax Cuts and Jobs Act TCJA doubled the lifetime gift estate and generation-skipping tax exemption to 1118 million from 56 million. 5 million adjusted for inflation.

Importantly the current doubled base exemption value of 10000000 is slated to sunset meaning that it will revert to 5000000 effective January 1 2026 unless Congress acts to extend current law. However this wont last forever. The conversation often begins with a question from a client such as I understand that the estate tax exclusion amount is very high under current tax law but that it is scheduled to revert back to much lower levels in 2026 when the current limits sunset.

Theres a limited time to this historically high exemption. The TCJA made significant changes to individual income taxes as well as estate and gift taxes. This resulted in a unified lifetime exemption of 11400000 in 2019 and 11580000 in 2020.

Notably the TCJA provision that doubled the gift and estate tax exemption from 5 million to 10 million adjusted annually for inflation will revert to pre-2018 levels after 2025. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation is expected to be about 62 million. Making large gifts now wont harm estates after 2025.

No Expected Estate Tax Exemption Increase Under The Build Back Better Legislation

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Three Estate Planning Strategies For 2021 Putnam Investments

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Do You Know The Times In Life When You Should Really Update Your Will Read These 12 Life Changers That Should Estate Planning Estate Tax College Savings Plans

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half Law Money Matters

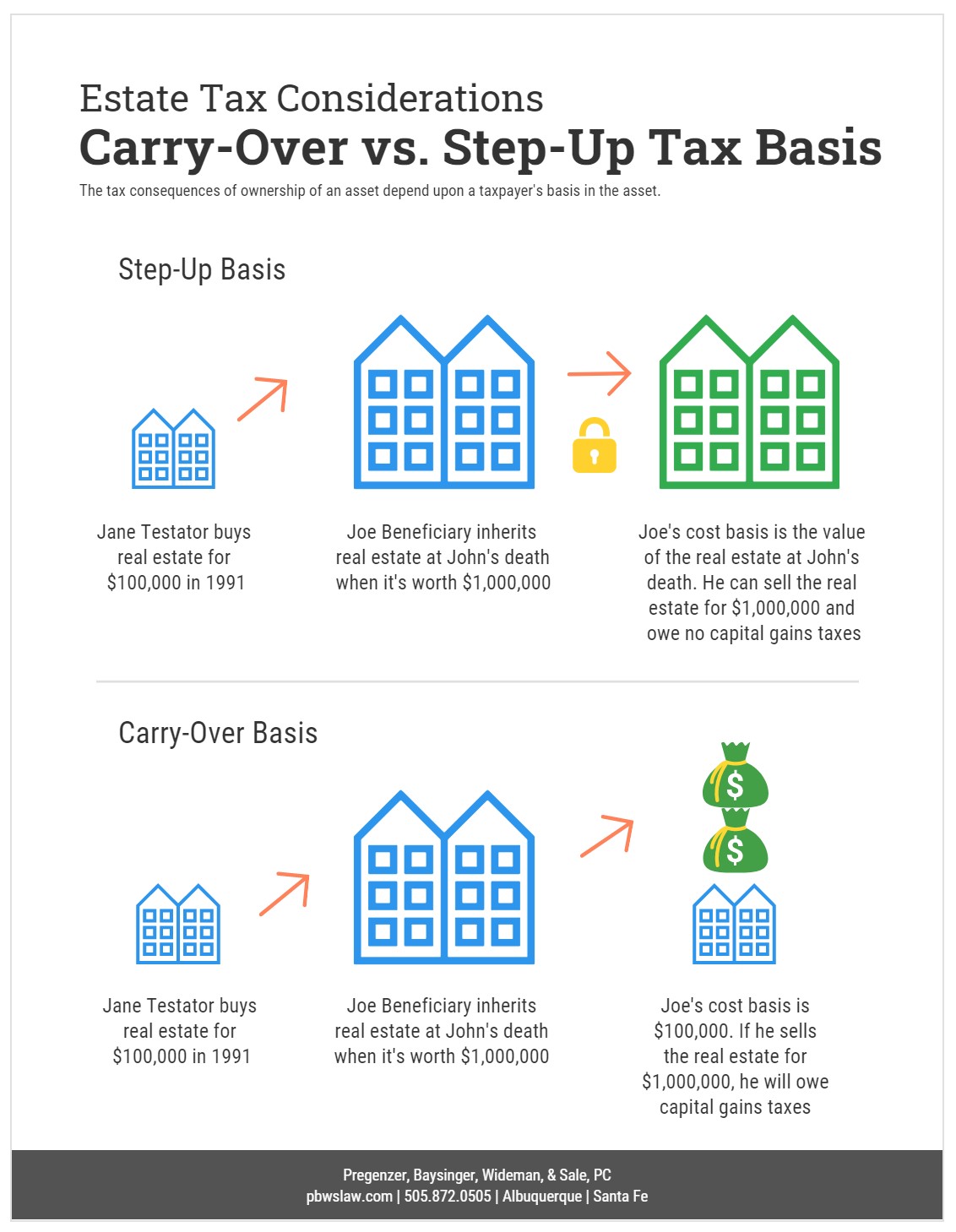

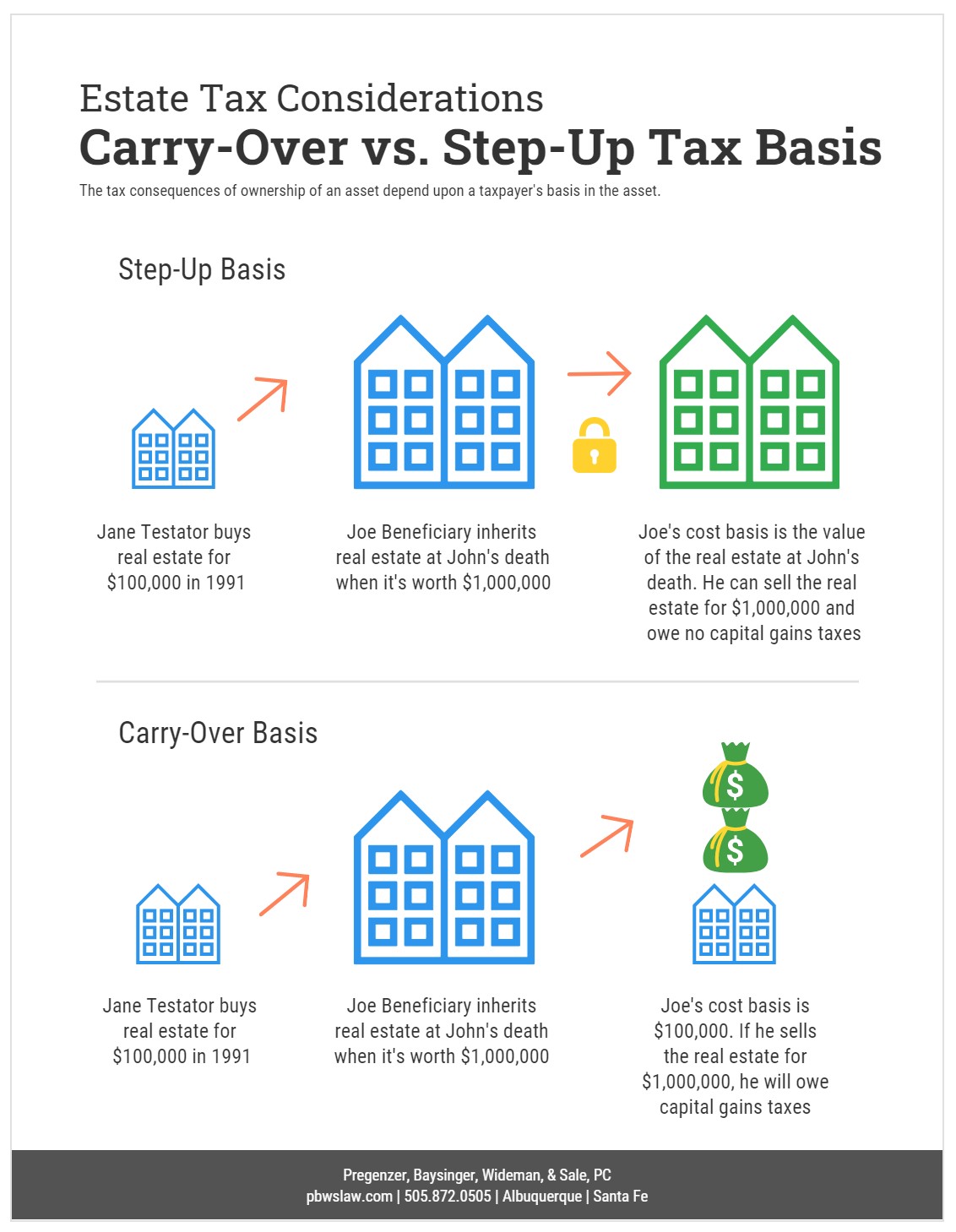

Biden Administration May Spell Changes To Estate Tax Exemptions And Basis Step Up Rule

Locking In A Deceased Spouse S Unused Federal Estate Tax Exemption

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

Estate Taxes Under Biden Administration May See Changes

Wealth Transfer Tax Planning Implications Of The 2017 Tax Act Williams Mullen Jdsupra

Will The Lifetime Exemption Sunset On January 1 2026 Agency One